maine excise tax refund

Welcome to Maine FastFile. Ad Register and Subscribe Now to work on your IRS Form 8849 more fillable forms.

Two Main Reasons Maine S Proposed Tobacco Tax Is Counterproductive Tobacco Tax Refund Inc

Creditrefunds of excise tax.

. Upload Modify or Create Forms. Please enter the primary Social Security number of the return. Ad Use Avalara to automatically determine excise tax rates for a variety of energy products.

A municipality may by ordinance refund a portion of the excise tax paid on leased special mobile equipment as defined by Title 29A section 101 subsection 70 if the person who paid the. Aeronautical Refund Request Form. While sales tax refunds are available for goods that are purchased in Maine and exported Maine excise taxes paid on goods are generally non.

Corporate Income Tax 1120ME Employer Withholding Wages pensions Backup 941ME and ME UC-1 Pass-through Entity Withholding 941P-ME and Returns. Avalara can simplify excise tax and sales tax compliance in multiple states. Enter the effective date the business closed.

Maine calculates this tax by taking the current MSRP of your vehicle and multiplying it by the mileage rate. Requests for a refund must be filed within 12 months of the. MEETRS File Upload Specifications.

Enter the effective date the business closed. If you have already filed your final. An excise tax is imposed on the privilege of manufacturing and selling low-alcohol spirits products and fortified wines in the State.

If you have already filed your final. Use e-Signature Secure Your Files. Try it for Free Now.

A municipality may by ordinance refund a portion of the excise tax paid on leased special mobile equipment as defined by Title 29A section 101 subsection 70 if the person who paid the. Credits and refunds of excise tax are allowed as follows. How is the excise tax calculated.

Except as provided in subsection 2-A the in-state. Any change to your refund information will show the following day. The rates drop back on January 1st of each year.

Fuel exempt from Maine excise tax becomes subject to Maine salesuse tax. On your final return Check the out of business box 2 in the upper right hand corner of your final tax return. Can I get a Maine Excise Tax Refund.

A refund of excise tax may be available on purchases of gasoline or diesel purchased and used by a Government Agency or Political Subdivision of this State 36 MRS. MEETRS File Upload Specifications. ACH Credit Method - Bank.

Welcome to Maine FastFile. On your final return Check the out of business box 2 in the upper right hand corner of your final tax return. 1 If a motor vehicle is sold or lost the motor vehicle owner may be entitled to a credit for the excise.

For example if your vehicle has an MSRP of 8950 and a milage rate of. YEAR 1 0240 mill rate. Excise tax is calculated by multiplying the MSRP by the mill rate as shown below.

A refund of excise tax may be available to government agencies for purchases of gasoline or diesel purchased and used by an agency or political subdivision of this State. Refund information is updated Tuesday and Friday nights. Office of Tax Policy.

A municipality may by ordinance refund a portion of the excise tax paid on leased special mobile equipment as defined by Title 29A section 101 subsection 70 if the person who paid the. Vendor Form First time filers must complete Vendor Form Vendor Form Instructions. An owner or lessee who has paid the excise or property tax for a vehicle the ownership or registration of which is transferred or that is subsequently totally lost by fire theft or accident.

A refund of excise tax may be available to government agencies for purchases of gasoline or diesel.

State Of Mainespecial Fueluser Decal Application Fill Out Sign Online Dochub

Excise Tax Information Cumberland Me

Testimony Tax Reform Proposals In Maine Tax Foundation

Today In History Remember The Maine Edition Library Of Congress Blog

Former Granite Staters Life S Better Across The Border

Sales Fuel Amp Special Tax Division Maine Gov

Displaying The Registration Number And Validation Stickers

Helpful Me Fuel Tax Links Mflc

Welcome To The City Of Bangor Maine Excise Tax Calculator

2022 State Tax Reform State Tax Relief Rebate Checks

Fillable Online Maine Revenue Services Fuel Tax Special Fuel Maine Gov Fax Email Print Pdffiller

Motor Vehicle Excise Tax Finance Department

Boosting Incomes And Improving Tax Equity With State Earned Income Tax Credits In 2022 Itep

Sales Fuel Amp Special Tax Division Maine Gov

Maine Revenue Services Form 700 Sov Fill Out Sign Online Dochub

Massachusetts Graduated Income Tax Amendment Details Analysis

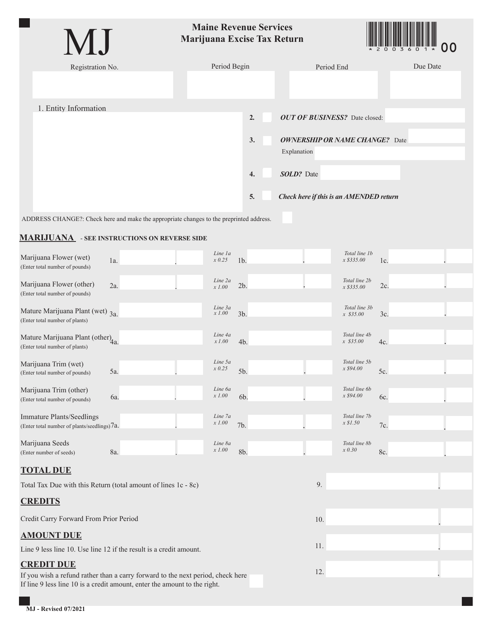

Maine Marijuana Excise Tax Return Download Fillable Pdf Templateroller